The biggest gold investment scams

Learn from some of the most harmful gold investment frauds of all times

Many investors want to profit from an expected long-term rise of the gold price or by using the asset class gold as a hedge to reduce the risk of their overall portfolios or even by short-term speculation. Like for any type of investment, unfortunately there are always some bad actors in the market, trying to take advantage of investors.

Gold scams exist in both regulated and unregulated gold investment products. Many private investors want direct ownership of physical gold, but do not want to safely store the gold by themselves. Vaulted gold products – where the investor’s gold is stored in professional vaults on his behalf – can satisfy this need. But in most countries they do not fall under any official regulation.

Therefore it is very important for investors to check especially such products diligently in order to minimise any risks from potential scams.

Below we take a look at some of the biggest actual or alleged gold investment fraud cases from the past decades. Investors can learn some lessons from these cases that support them in making better choices for themselves when investing in gold.

Stay with us, the cases are often scary and sometimes entertaining. Damages to investors rise up into the hundreds of millions of US-dollars.

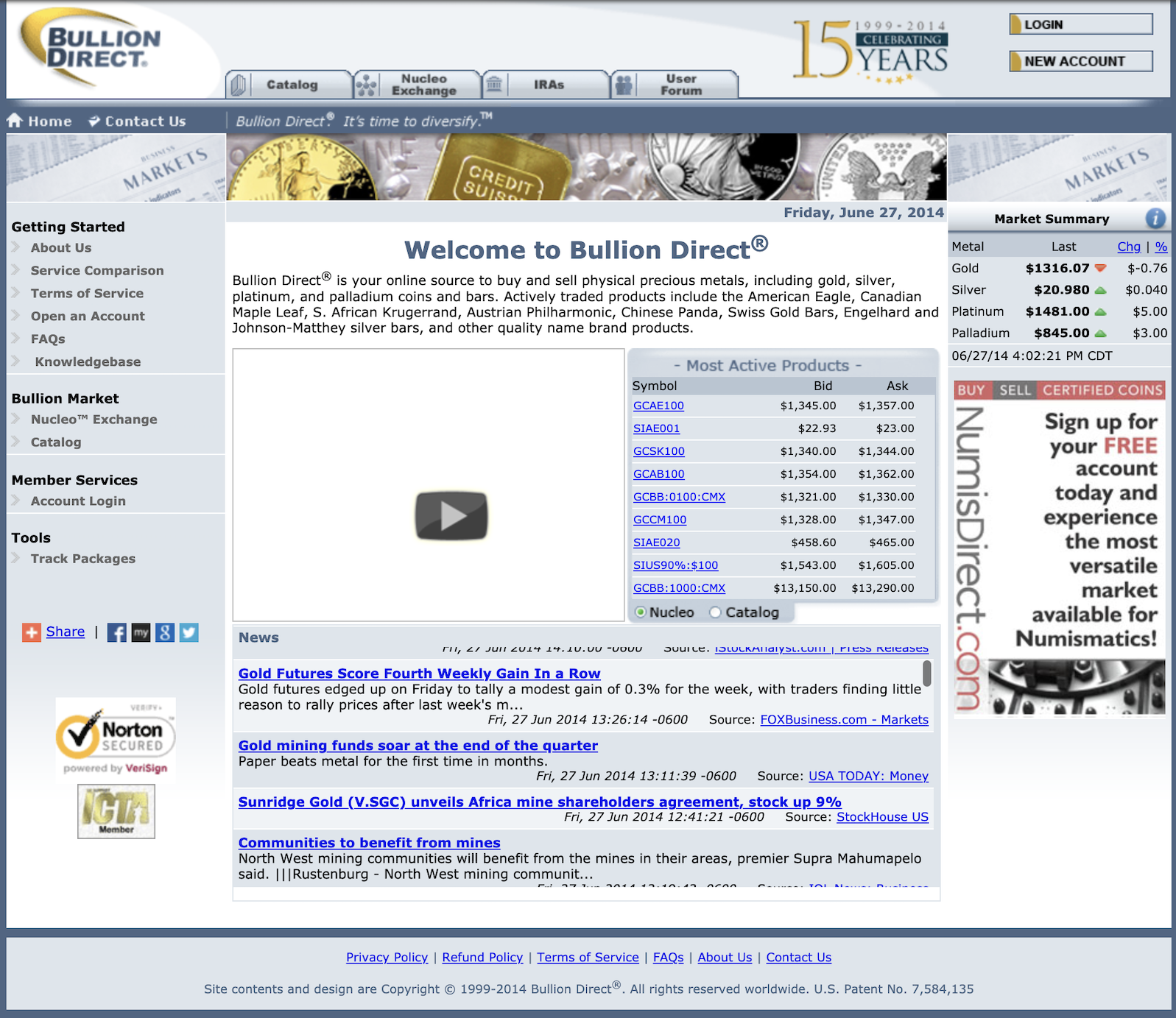

11. Bullion Direct Inc. (United States of America, estimated losses of US$ 16 million)

In February 2020, the CEO and owner of Bullion Direct, Inc. was sentenced to 10 years of federal prison for an investment and wire fraud scheme as well as for money laundering. He was also ordered to pay restitution in the amount of US$ 16 million to the victims of his scheme. About 5,800 investors were affected by the fraud.

The defendant was found guilty with the help of an FBI Special Agent and an IRS Criminal Investigation Special Agent.

Over a timeframe ranging from at least January 2009 through July 2015, investors were misled into believing that their funds would be used to buy precious metals on their behalf. The funds for the purchase of precious metals, which were claimed to be stored in Bullion Direct’s vault, were instead used for buying property or on corporate expenses for the personal benefit of the defendant.

Lesson for investors:

- If you buy vaulted gold, ensure that you get regular statements of your personal gold holdings from a trustworthy 3rd party.

Source:

10. Suisse International (Singapore, estimated losses of up to US$ 25 million)

In February 2015 over 260 investors claimed a total of more than US$ 25 million in losses from falling victim to a gold buyback scheme in Singapore.

The company Suisse International had allegedly failed to pay investors by the deadline set for end of January 2015, which was set by the firm after it purportedly defaulted on paying out money for months.

According to claims the company had promised investors returns between 20 and 25 percent. It argued to generate the promised returns through the sale of limited-edition coins made from gold it had purchased.

Lesson for investors:

- Don’t believe any promise of guaranteed returns, all investments involve potential risks.

Source:

Over 260 investors lodge police reports on gold buyback scheme

9. Gold Sukh (India, estimated losses of up to US$ 32 million)

In 2012, five fugitive directors of the Indian investment company Gold Sukh Trade India Private Limited, were arrested in Vietnam after an international Red Notice was issued by Interpol, the International Criminal Police Organization with 194 member countries.

Only in June 2020, the Enforcement Directorate, a specialised financial investigation agency under the Ministry of Finance of the Government of India, finally filed a charge against 12 people connected to the case. The persons are accused of having run a multi-level-marketing and ponzi scheme, defrauding nearly 120,000 investors of about US$ 32 million.

It is alleged that the company, its leaders, their relatives and shareholders had laundered money generated from the offences. The funds were invested in property, foreign currencies and cash held in bank accounts.

Lesson for investors:

- There is only limited information available on the concrete of the multi-level marketing and ponzi scheme, so the lesson is: Be careful.

Sources:

‘Gold Sukh cheated 100,000 investors’

Enforcement Directorate chargesheets 12 people in 12-year-old ponzi scam

8. BWF-Stiftung (Germany, estimated losses of up to US$ 60 million)

From 2011 on, the Berlin-based BWF-Stiftung (“BWF-Foundation”) offered allegedly safe gold investments to investors. The organisation promised to use investor funds for the purchase of physical gold and the storage on behalf of the investor. The organisation, which also became known as “Bund Deutscher Treuhandstiftungen” (Association of German Trust Foundations) also claimed to generate an attractive return by means of a smart business strategy for its about 4.000 customers.

The purchase of gold was linked to a so-called buy-back option. This could be exercised after several years. The BWF-Stiftung guaranteed a buyback price of between 110 percent and 180 percent. The later the repurchase option was exercised, the higher the promised return.

It turned out that only some of the funds of the investors were used to purchase gold. Many gold bars in the vault were fake and only covered with a thin layer of gold for disguise.

In 2015, the German magazine Finanztest, a magazine of the German Stiftung Warentest, a non-profit foundation and consumer organisation, expressed serious concerns about the management and sales of BWF-Stiftung. In the same year, the German Federal Financial Supervisory Authority banned the organisation from operating any further business because it operated a prohibited bank deposit business, for which BWF-Stiftung lacked the respective license.

In 2017, four defendants were sentenced to prison terms of five to six years.

Lesson for investors:

- Don’t believe any promise of guaranteed returns, all investments involve potential risks.

- If you buy vaulted gold, ensure that you get regular statements of your personal gold holdings from a trustworthy 3rd party.

Sources:

BWF-Stiftung – Haftstrafen für vier Angeklagte

7. Tianjin Group (Taiwan, estimated losses of up to US$ 63 million)

In January 2016, 25 persons from Taiwan and seven from Singapore were charged with running a gold-buy-back scheme under Taiwan’s Banking Act.

Under the scheme, investors were promised 24 percent profit and in addition 1 percent interest every month for 24 months. After a period of two years, the company promised to buy back the gold at the original price. In order to participate in the scheme, customers had to first pay about US$ 2.500 as a membership fee.

The gold bars were sold at about the double price of the actual cost. In total, about 5,000 investors were affected, all of them paid the membership fee.

The fraud also involved a pyramid scheme, which promised members a commission of 2-16 percent for every other investor they recruited. The fraudsters as well as some members used the display of their wealth to attract new investors.

Some of the sold gold bars were fake and had counterfeited certificates.

Lesson for investors:

- Don’t believe any promise of guaranteed returns, all investments involve potential risks.

- Check the prices you pay for any precious metals.

- Avoid schemes which are paying investors for recruiting other investors.

- The open display of wealth is a warning signal.

Sources:

Singaporeans and Taiwanese Suspects Charged for Gold Scam

7 S’poreans face charges in Taiwan over $80m gold scam

6. KBC – KaratGoldCoin (Germany, Belize, potential losses of more than US$ 100 million)

The KaratGoldCoin (KBC) is a crypto-coin, which was launched in 2018. Allegedly it is linked to or backed by physical gold. It was claimed that the KaratGoldCoin would address inefficiencies and fragmentation of the existing payment system through a solution based on gold and crypto-coins.

Already in October 2019, BaFin had issued a cease and desist order against Karatbit Foundation – an organisation behind the scheme – to immediately stop and wind up unauthorized electronic money business in Germany and the issuance of the KaraGoldCoin without the necessary licence.

At its peak in December 2019, the market cap of the KaratGoldCoin reached about US$ 220 millions, currently it stands at close to zero.

The promise of the organisation behind KaratGoldCoin to secure purchased coins with gold seems questionable. According to the public prosecutor, “it is highly doubtful whether gold of any appreciable magnitude was actually available or whether this promise was merely intended to ‘bait’ investors…. Many customers did not receive any coins despite payment, while other customers received a multiple of the coins paid.”

One witness even reported that 700 million coins had not been sent to customers because of programming errors, even though investors had already paid for the coins. According to the public prosecutor’s office, individual bookings cannot be traced because the databases no longer exist.

Key persons involved in the organisation posed with luxury cars such as a Bentley and a Lamborghini. The German regulator decided that the money must be paid back to investors in Germany. It is unclear what damage was ultimately caused for investors who bought KaratGoldCoins at much higher prices than they later could be sold for – in the worst case close to zero.

Lesson for investors:

- If you buy vaulted gold, ensure that you get regular statements of your personal gold holdings from a trustworthy 3rd party.

- The open display of wealth is a warning signal.

- Be especially careful regarding tokenized gold, i.e. crypto gold products

Sources:

Karatbit Foundation: BaFin issues cease and desist order

Die Staatsanwaltschaft zweifelt an den Goldreserven der Karatbars-Gruppe

5. PIM Gold (Germany, estimated losses of up to US$ 155 million)

In 2019, the German gold dealer PIM Gold filed for insolvency. As of today, approximately 7.000 to 8.000 investors have been harmed. The insolvency administrator of PIM Gold has so far been able to meet only 7.5 percent of creditors’ claims. Instead of 3 tonnes of gold, only about 270 kilograms and 180 kilograms of jewelry were discovered. To date, there are justified claims amounting to about 140 million euros.

With an initial payout, the investors received a rate of 7.5 percent on the determined claims. If additional funds are found, creditors could expect another payment.

According to the charges, the company is alleged to have concluded contracts for delivery, including promises of bonuses, with customers for hundreds of kilograms of gold from 2016 to September 2019, but failed to fulfill them. Interest is said to have been paid out in a kind of snowball system via newly recruited customer funds.

Lesson for investors:

- Don’t believe any promise of guaranteed returns, all investments involve potential risks.

- If you buy vaulted gold, ensure that you get regular statements of your personal gold holdings from a trustworthy 3rd party.

Source:

PIM-Insolvenzverwalter setzt Privatdetektiv ein

4. TMTE Inc. (United States of America, estimated losses of up to US$ 185 million)

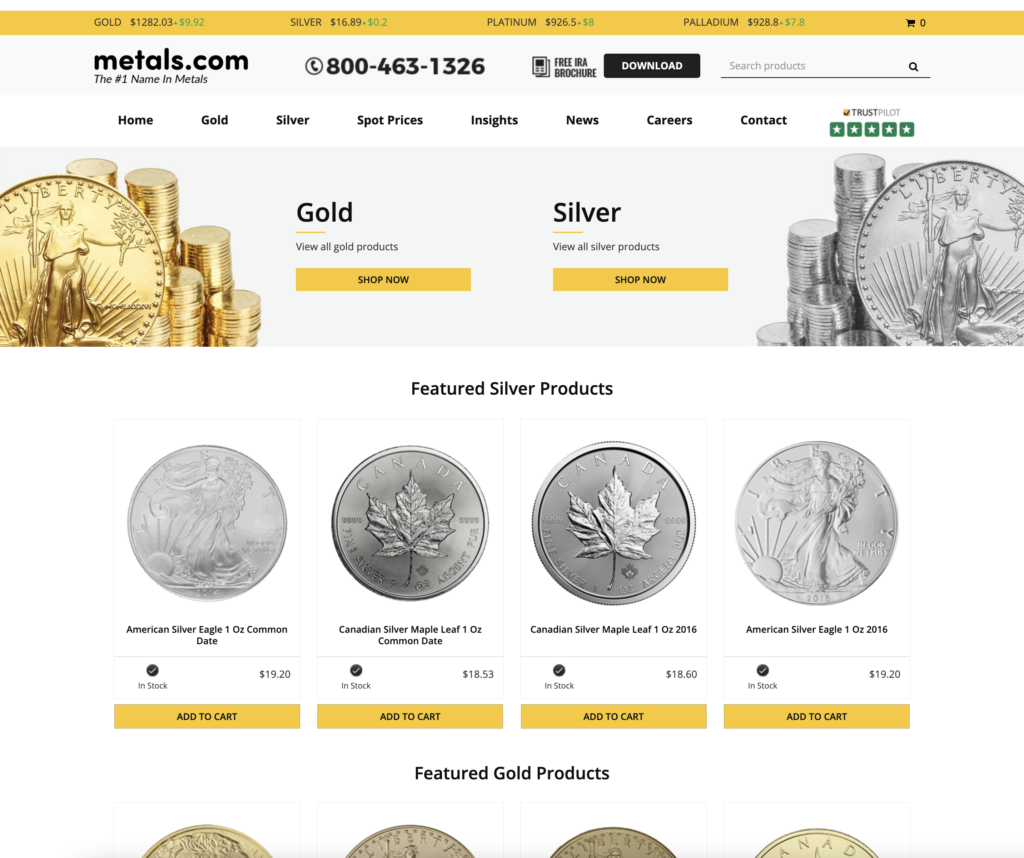

In September 2020, the precious metal dealer TMTE Inc. was accused by the Commodities Futures Trading Commission and 30 states of the United States of defrauding senior citizens by US$185 million. The company TMTE Inc. (also known under other names such as metals.com) allegedly sold precious metals at up to 300 percent of their market value to about 1,600 customers.

It was particularly delicate that a nonprofit of the former chief strategist of Donald Trump, Steve Bannon, could be connected to TMTE Inc., because it had worked with Platinum Advertising, which is tied to TMTE Inc. as various legal documents show.

According to the news site Daily Beast “Articles … detailed how the company used a combination of politically themed Facebook ads, talk radio spots, misleading websites, and high-pressure telephone sales tactics to target right-leaning, Fox News-viewing retirees and convince them to purchase gold and silver at hugely inflated rates. These efforts often involved overt biblical appeals, or echoed the rhetoric of President Donald Trump and Republican pundits by invoking the threat “liberals” and the “Deep State” supposedly posed to the economy and to the victims’ personal finances.”

Lesson for investors:

- Don’t fall victim to fearmongering or other hard-selling tactics.

- Check the prices you pay for any precious metals.

Sources:

Steve Bannon’s Dodgy Nonprofit Teamed Up With Company Linked to Accused Gold Scammers

3. Amber Gold (Poland, estimated losses of up to US$ 236 million)

The Polish ‘gold shadow bank’ Amber Gold defrauded about 19,000 customers of about US$ 236 million over the years 2009 to 2012.

In the years before founding Amber Gold, the founder of Amber Gold had been several times sentenced for fraud in Poland. But each time the sentence was conditionally suspended.

Amber Gold offered its customers investments in gold and other precious metals. It ran ads promising guaranteed returns of up to 14 percent. The government of Poland and other institutions had been warned – among others by the Polish Financial Supervision Authority – since 2009 to change laws in order to protect investors from pyramid schemes such as the one operated by Amber Gold. The Polish Financial Supervision Authority had already warned the public in 2010 on its website that Amber Gold had no banking license.

Only in 2012, the Internal Security Agency of Poland started an investigation. This was followed by Amber Gold’s declaration of bankruptcy later that year.

In 2019, the founder of Amber Gold was sentenced to 15 years in prison, his wife to 12 and a half years. Many of the people who had put their savings into the company have still not received their money. The case caused a political controversy in Poland.

Lessons for investors:

- Don’t believe any promise of guaranteed returns, all investments involve potential risks.

- Look for warnings by official agencies.

Sources:

Amber Gold founders guilty of financial fraud: district court

2. OSGold (United States of America, estimated losses of up to US$ 250 million)

OSGold was founded in 2001 and folded the next year. According to a lawsuit filed in the U.S. District Court in 2005, the operators of OSGold may have made off with US$ 250 million. It was reported by CNet that “the OSGold currency boasted more than 60,000 accounts created by people drawn to promises of ‘high yield’ investments that would provide guaranteed returns of 30 percent to 45 percent.”

In 2009 the FBI announced the arrest of the founder of OSGold “on charges stemming from the operation of an international, Internet-based, “gold unit” Ponzi scheme.”

The scheme was allegedly partially backed by gold bullion stored in an off-shore vault. Customers opened accounts, wire-transferred money, and were able to monitor their supposed holdings through the website of OSGold. Around May 2001, the defendant began offering customers the opportunity to invest in a “high yield investment program” known as “OSOpps”. The program promised a compounded return of 30 percent over three months, or a 45 percent rate of return for investments left for 12 months, and that an investor’s principal was fully guaranteed.

Before OSGold ceased operations, about 66,000 accounts were opened from customers around the world, and at least US$ 12.8 million were transferred by customers, according to the FBI.

Operations were stopped around June 2002, after an investor unsuccessfully tried to withdraw his funds. It came to light that the customers’ funds had been laundered through various banks and ultimately used for personal expenses by the founder and his associates, including their businesses such as a night club and a shopping mall in Mexico. Account statements were manually altered, so that they showed the promised investment returns.

According to the FBI “Millions of dollars of the investors’ and depositors’ money, including principal, have never been returned. No gold bullion reserves associated with OSGold have been located.”

Lessons for investors:

- Don’t believe any promise of guaranteed returns, all investments involve potential risks.

- If you buy vaulted gold, ensure that you get regular statements of your personal gold holdings from a trustworthy 3rd party.

Sources:

Arrest in Multi-Million-Dollar Internet “Gold-Unit” Ponzi Scheme

1. Monex (United States of America, estimated losses of up to US$ 290 million)

In 2017, the Commodity Futures Trading Commission (CFTC) charged Monex and affiliated companies of defrauding customers through a multi-million dollar fraudulent precious metals scheme.

According to the CFTC, from 2011 and through March 2017 investors were solicited to invest in commodity trading pools. The alleged scam led to thousands of retail customers investing more than US$ 290 million under the “Atlas” Program in leveraged trades in gold and other precious metals.

The CFTC’s Director of Enforcement stated in 2017: “Today, we announce the filing of one of the largest precious metals fraud cases in the history of the Commission. As alleged, the Defendants defrauded thousands of retail customers – many of whom are elderly – out of hundreds of millions of dollars as part of a multi-year scheme.”

The CFTC claimed that Monex representatives “deceptively pitched leveraged trading through the Atlas program as a safe, secure, and profitable way to invest in precious metals” using high-pressure sales tactics, which led many investors to lose their life savings.

Lessons for investors:

- Don’t believe any promise of guaranteed, safe returns, all investments involve potential risks.

- Don’t fall victim to hard-selling tactics.

- Be especially careful with regards to leveraged trading.

Sources:

High Court Sides with CFTC on its Authority Scope over $290M Fraud Case